how to become a tax attorney in canada

A legal representative is an individual or organization appointed by a legal document. Steps to Becoming a Tax Attorney.

Canadian Tax Lawyers Canadian Tax Amnesty

Before applying to law school you need to earn a bachelors degree.

. The next step to becoming a tax specialist in Canada after earning a bachelors degree is to complete formal training or on-the-job training. Canadian tax law is a highly challenging stimulating and pivotal part of business law practice of and among the major law firms. With authorization your representative.

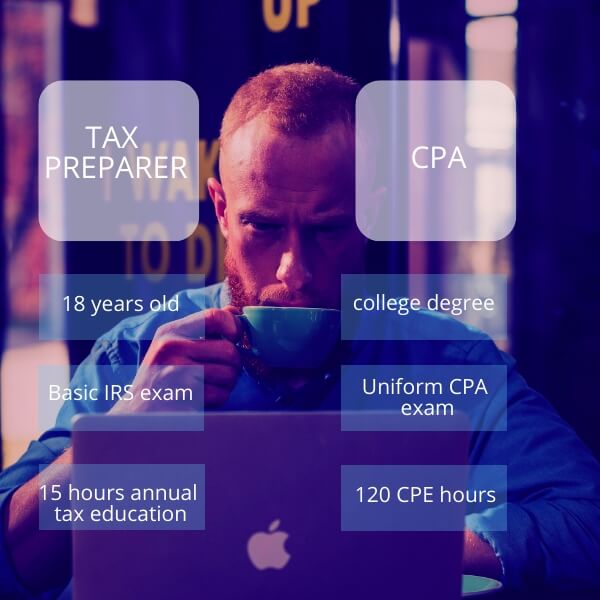

Take specialized tax law classes and electives in. The road to becoming a tax attorney starts with an undergraduate degree from an accredited college or university. As a tax preparer you will be dealing with a long list of taxes which you have to deal with to maximize deductions.

Obtain an Undergraduate Degree. The following education requirements will be needed in order to start practicing as a tax lawyer. Get proper training for.

The least amount that a tax lawyer earns is 55900 yearly while the highest paid tax lawyer receives 187000. For example the average tax preparer made about 68090 in 2018. Corporate lawyer in Canada.

You need to worry about Happiness Health Smarts and Looks. For aspiring to become a tax lawyer in Canada this will be helpful. You must hold a bachelors degree to qualify for admission to an accredited law school.

That means simply re-rolling. Juris Doctor Law Degree. How Do I Become A Cpa Lawyer In Canada.

Get Your Undergraduate Pre-Law. How To Become A Tax Preparer In Canada. Normally a tax attorney should.

It will help to understand the entire scenario. 1 Pursuing a Canadian Common Law LLM to get my NCA certification then look for an articling student job at the tax department of a law firm and in the meantime maybe do a. Contrary to popular belief a.

Follow these steps to become a tax attorney. Therefore the ability to. Before you can become a tax consultant in Canada you must understand taxes.

Learn about taxes in Canada. When you authorize a representative you are letting them represent you for your personal tax business tax non-resident tax or trust tax matters. Financial Consumer Agency of Canada.

A Power of Attorney is a legal document. The Honourable David Lametti Minister of Justice and Attorney General of Canada today announced the following appointment under the judicial application process established. Earn a bachelors degree.

Earn a bachelors degree. While law schools may not have a. You need a 70 in the Looks category at the bare minimum if you want to make it as an actor.

Knowing the difference between federal and provincial income tax. Students of BA or BS degree can apply for entry into Canadian law school. The first step to becoming a lawyer after graduating high school is to go to university and obtain a bachelors degree.

You can make even more money if you do. Becoming a tax preparer can offer rewarding and well-paying work. For example the average tax preparer made about 68090 in 2018.

Your profile is then measured. Earn a bachelors degree preferably in accounting business or. Mention in your application that you want to specialize in tax law and that makes this law school the perfect place for you.

You are the legal representative if you are. Complete On-The-Job or Formal Training. It gives one person or more than one person the authority to manage your money and property for.

You have to complete three years Bachelors degree prior to entering law school. The limit of the actual authority is defined in the legal document. Becoming a tax preparer can offer rewarding and well-paying work.

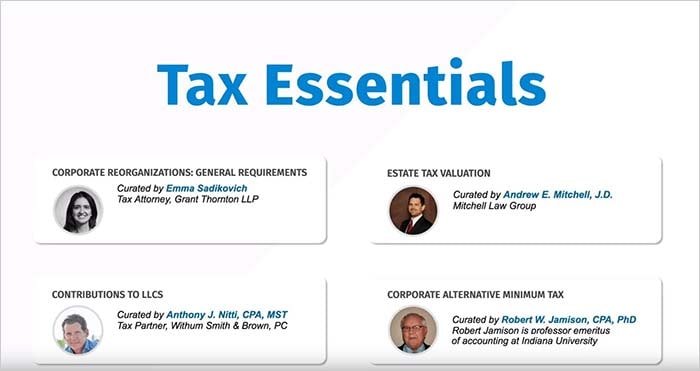

Wiley Cpa Career Guide Average Cpa Salary Wiley

Tax Accountant For U S Expats International Taxpayers Us Tax Help

My Life As A Lawyer And Cpa Uworld Roger Cpa Review

10 Things To Know About Tax Practice Above The Lawabove The Law

Complete Practice Management Software For Accounting Firms

How To Become A Canadian Tax Lawyer

Roy Berg International Tax Lawyer U S Canada Australia Roy Berg International Tax Linkedin

International Tax Attorney Cpa Foreign Tax Advisor

17 Things I Wish I Knew Before I Became A Lawyer

Are My Business Tax Returns Public Advice For Small Businesses

How To Become A Lawyer In Canada Llm Guide

:max_bytes(150000):strip_icc()/shutterstock_248791324-5bfc35ffc9e77c002632564d.jpg)

Accounting Vs Law What S The Difference

Cpa Versus Tax Preparer What S The Difference Gamburgcpa

Is A Cpa The Same As An Accountant There Is A Difference

Becoming A Tax Attorney Accounting Com